Generali confirms the Group’s excellent profitability, with strong growth in premiums, operating and net results. Extremely solid capital position

03 Aug 2021

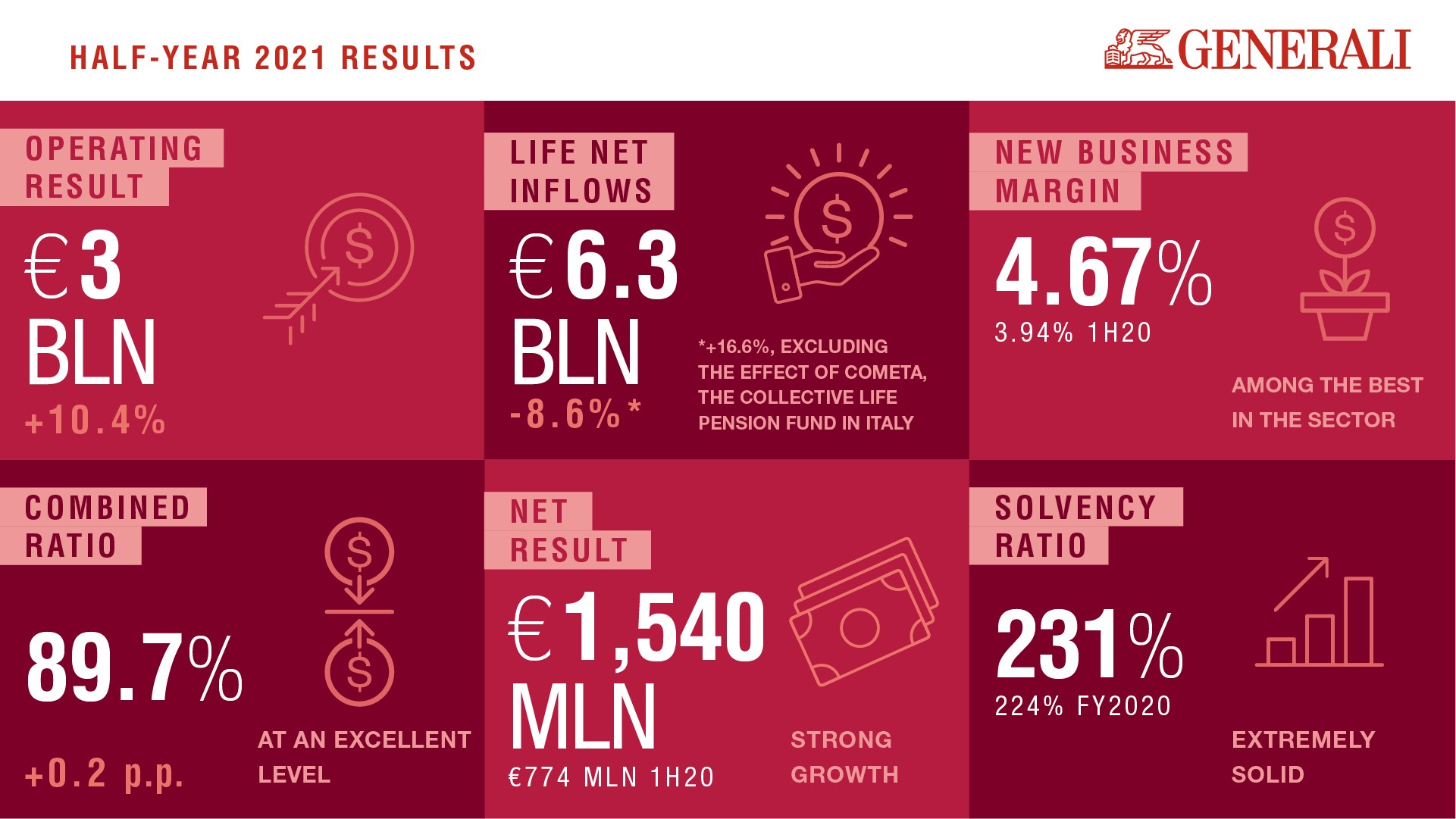

- Operating result rose to € 3 billion (+10.4%), thanks to the positive performance of the Life, Asset Management and Holding and other businesses segments. The excellent contribution from the P&C segment was confirmed

- Gross written premiums increased to € 38 billion (+5.5%), up in both the Life segment (+5.8%) and the P&C segment (+4.9%). Strong Life net inflows at € 6.3 billion (-8.6%)2. The New Business Margin was excellent, and at 4.67%, among the best in the sector (3.94% 1H20). The Combined Ratio was substantially stable at 89.7% (+0.2 p.p.)

- Strong growth in the net result which rose to € 1,540 million (€ 774 million 1H20)3

- Solvency Ratio was extremely solid at 231% (224% FY2020)

- The Group is fully on track to meet its targets for the year and successfully complete the ‘Generali 2021’ strategic plan

The Generali Group CEO, Philippe Donnet, stated: “Today’s excellent results confirm that we are fully on track to successfully deliver the ambitious targets of the current ‘Generali 2021’ plan, even in this very challenging environment. The significant growth achieved in the first six months of the year strengthens Generali's position as the European leader, thanks to our operational excellence, the acceleration of our digital innovation and the quality of our distribution network. We will continue to forge ahead with an even stronger focus on our Lifetime Partner ambition, leveraging on the enthusiasm, passion and energy of our 72,000 colleagues and 165,000 agents worldwide, and we look forward to presenting the new plan at the Investor Day on December 15th.”

Milan - At a meeting chaired by Gabriele Galateri di Genola, the Assicurazioni Generali Board of Directors approved the 2021 Consolidated Half-Year Financial Report of the Generali Group, expressing its satisfaction for the excellent results achieved in a particularly challenging environment.

The operating result rose to € 2,996 million (+10.4%), benefitting from the positive performance of the Life, Asset Management and Holding and other businesses segments. The contribution of the P&C segment was excellent, despite the impact of several significant natural catastrophe claims in continental Europe. The Life and P&C segments confirmed excellent technical profitability, demonstrated by the New Business Margin at 4.67% (3.94% 1H20) and a substantially stable Combined Ratio at 89.7% (+0.2 p.p.). The operating result of the Asset Management segment reached € 306 million (+39.6%), mainly boosted by the rise in operating revenues, also supported by the increase in assets under management.

The non-operating result was € -496 million (€ -941 million 1H20). The significant improvement was thanks to the lower impairments on available for sale investments – which were particularly affected in 1H20 by the impact of the pandemic on financial markets – and the increase in the realised gains, mainly deriving from equities and € 67 million for a real estate transaction for the Libeskind Tower in CityLife, Milan. The first half of 2020 was also impacted by the impairment on goodwill related to the Life business in Switzerland for € 93 million, the one-off expense of € 100 million4 for the Extraordinary International Fund for Covid-19 and further local initiatives for € 54 million to face the pandemic. The impact of interest expenses on financial debt further improved, as a result of the debt optimisation strategy.

The net result significantly increased to € 1,540 million (€ 774 million 1H20) driven by the operating result and the non-operating performance, mentioned above.

The gross written premiums increased to € 38,093 million (+5.5%), thanks to positive growth in both business segments.

Life net inflows were strong and stood at € 6.3 billion (-8.6%)5, the decrease was attributable to the savings and pension line, consistent with the Group’s portfolio repositioning strategy. Both the protection (+10.3%) and unit-linked (+0.9%) lines recorded growth.

Life technical provisions grew to € 393.4 billion (+2.3%; +3.4% excluding the effect from the deconsolidation of a pension fund in central and eastern European countries).

The Group's Total Assets Under Management reached € 672.4 billion, up +2.7% from 31 December 20206.

The Group's shareholders' equity was € 28,412 million, -5.4% compared to 31 December 2020. The change was due to a € 1,014 million decrease in the AFS reserves, deriving mainly from the performance of government bonds and the deduction of the entire dividend approved for a total of € 2,315 million, of which € 1,591 million related to the 2020 dividend, paid on 26 May 20217.

The Group confirmed its excellent capital position with the Solvency Ratio at 231% (224% FY2020). The increase of 7 p.p. was mainly attributable to the excellent normalised capital generation, net of the dividend for the period, calculated on a pro rata basis from the previous year’s dividend, and to market variances. These positive trends more than offset the impact of the regulatory changes at the beginning of the year, operating variances (in particular, re-risking) and M&A transactions.

In addition, the Board resolved to launch the preparatory activities of the procedure to define a possible slate of candidates for the Board renewal in 2022: said procedure will be submitted to the next meeting of the Board of Directors on 27 September.

[This is only the executive summary of the release. The full version can be found in the PDF below]

Download the Full Release